You don’t have the Virus but your losses are still huge

We are receiving calls from clients fearful that their market losses are going to require them to claim social security benefits years earlier than they had otherwise planned. This has an impact on their long term income [i.e. the sooner you collect, the lower the amount monthly], but there are ways to supplement that lower income stream using savings you still have. Call us if you’d like more information on the new Covid-assistance bill that permits you to withdraw funds from some types of retirement accounts that prohibit you from purchasing an Annuity that would provide you with an income stream you can’t outlive, and moving those funds to a different retirement account where you can make that purchase. Call us if you’d like more information on this. We’re always here to help.

You don’t have the Virus but your losses are still huge

We are receiving calls from clients fearful that their market losses are going to require them to claim social security benefits years earlier than they had otherwise planned. This has an impact on their long term income [i.e. the sooner you collect, the lower the amount monthly], but there are ways to supplement that lower income stream using savings you still have. Call us if you’d like more information on the new Covid-assistance bill that permits you to withdraw funds from some types of retirement accounts that prohibit you from purchasing an Annuity that would provide you with an income stream you can’t outlive, and moving those funds to a different retirement account where you can make that purchase. Call us if you’d like more information on this. We’re always here to help.

VERY IMPORTANT UPDATE

VERY IMPORTANT UPDATE

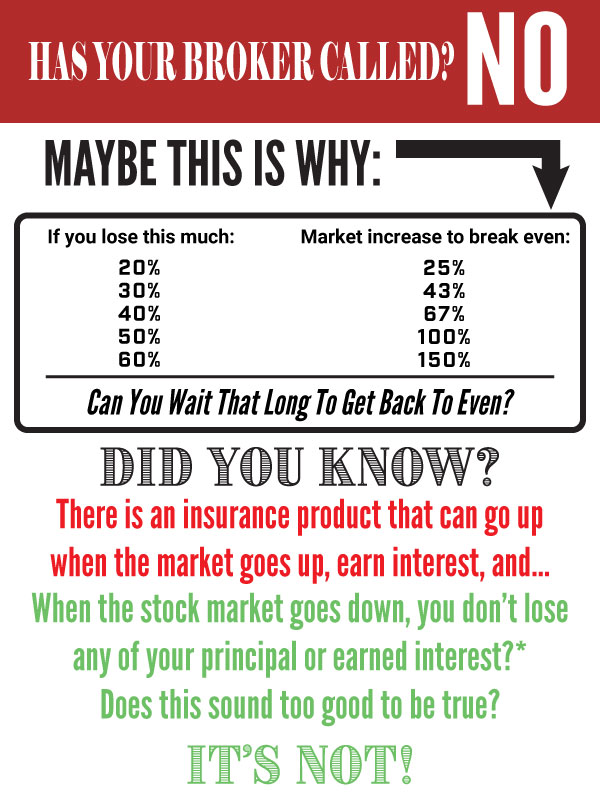

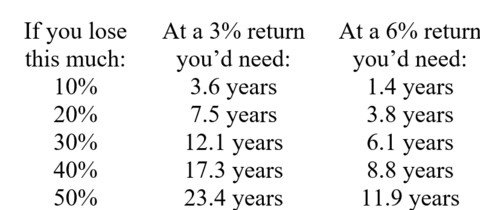

How many more years do you need to live in order to wait it out?

With all that is going on in the market with the Coronavirus, we have received many requests to give our opinion on how long it will take for a retirement savings to get back to the level it was before the virus took its toll on the market. Understanding that no one can predict what kind of return anyone is receiving on their savings, and knowing that returns are always investor specific, what we can do is provide you below with the mathematical formula for you to apply to your own situation, and under your own assumptions.

Concerned you’d need too many years? Call us. Maybe it’s time to protect a portion of what is left of your retirement savings from more loss. We have some ideas that you may want to know about.

Concerned you’d need too many years? Call us. Maybe it’s time to protect a portion of what is left of your retirement savings from more loss. We have some ideas that you may want to know about.

We know you are concerned

Financial concerns stemming from the coronavirus outbreak have saturated the thoughts of anyone with a retirement nest egg set aside. The coronavirus has had an undeniable impact on any of us who are in retirement or who are, or were, contemplating it in the near future. Call us, we’re here to offer out some options that can help with your retirement cash flow. We’re always here to help and are standing by for your call.

Safety planning for retirement

I found this week’s article full of interesting information, and was drawn to the opening paragraph that I thought to share with you. “As we progress through life, we find there are certain things we can control and others we cannot. However, even with the things we can’t control, we can exercise good judgement based on facts, due diligence, historical patterns and a risk/reward calculation. These strategies play an important role in retirement planning. When it comes to accumulation, spending and protecting your nest egg, financial analysts rely heavily on safety and probability planning strategies.” The author goes on to discuss how one “safety” contract “is an income annuity, which offers the option to pay out a steady stream of income for the rest of your life and the life of your spouse – even if the payouts far exceed the premiums you paid. This is a way of ensuring you continue to receive income even if you run out of money”. Take a look at the article, and give us a call if you would like to talk about options like this. We’re always here to help.

Get back on your feet

This week’s article references how setbacks can affect family decisions, and finances, at every live stage, but it tells you to “Get back on your financial feet even if you’re getting a late start.” We agree. It is sometimes daunting to reestablish financial security after struggles, whether they have been from job downsizing, increased expenses relating to helping out other family members, or unexpected health issues. Regardless, it is important to start again. We’re always here to help, so call us if you’d like to talk about your choices, no matter where you are in your planning.

Building your own

We often hear that “the key to feeling confident about a comfortable retirement is an employer plan”, but what if you don’t have one? I thought to share this week’s article with you because it discusses how to build your own, and compares the various options, including a solo 401(k). Call us if you’d like to talk about it, we’re always here to help.

Click Here to Read Full Article

Did you know?

Did you know about the new Secure Act which allows you to wait longer before you have to start withdrawing money from your qualified retirement accounts, such as your 401(k) or IRA? I thought to share with you this week’s article because it explains that “the new age limit for required minimum distributions (RMDs) is now 72, up from 70½. The change applies to those turning 70½ after Jan. 1, 2020. This delay gives your money a bit more time to grow in a tax-sheltered account while postponing your tax bill.” Did you also know “even if you have more time to wait, it’s still crucial to take your distribution on schedule. If you miss your RMD, you will end up owing a 50 percent penalty on the amount. That’s on top of the ordinary income tax you must pay on the money you withdraw.” (Read more about calculating your RMD in this week’s article.) Call us if you need any help understanding how the changes impact on your retirement savings plan. We’re always here to help.